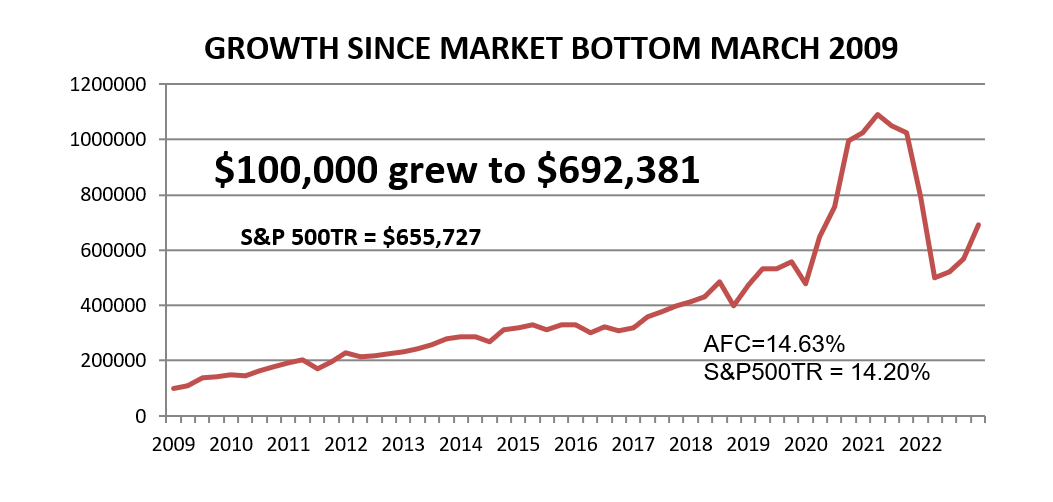

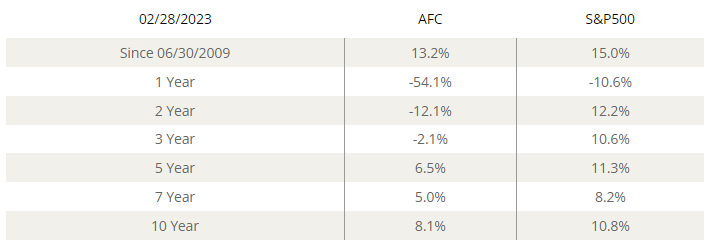

AFC client returns ranged from 14% to over 40% for the quarter compared to 7.5% for the S&P 500 with dividend reinvested. Our client agreement says we seek to do better than the S&P 500 with dividends reinvested over the longer-term, which we say is 5 to 10 years. You can see that for the composite of actual client accounts, we have achieved this goal for the five-, seven-, and ten-year periods as well as since inception.

We feel the highest probability is the market bottomed on October 12, 2022 and is now on the way to new highs. We feel we have an enviable track record that few, if any, financial advisors can equal over the longer-term.

We have been saying since 2016 that inflation would arrive and that it would persist for a number of years. Our assessment is that the Fed will raise rates a few more times and then hold steady at a higher level for a number of years. There are reasons for our assessment, and if you have been reading our newsletters over the last few years you understand why we predicted inflation and why we feel it will continue.

In 2019, if someone had told you that in 2020 there was going to be a disease that no one had ever seen before and millions of people would die, would you have believed them? If, in 2019, someone told you there would be a war that broke out at the beginning of 2022 and most of the nations of the world would choose sides, support the war effort, and even participate in supplying armaments, would you have believed them? Things that have never happened before happen all the time.

If you are not a client, doesn’t it make sense now to see how you can join?

Footnotes:

- Past performance is no guarantee of future performance

- AFC uses the S&P 500 with dividends reinvested as the comparable index for all accounts.

- AFC Managed Accounts returns include all active accounts as well as all closed accounts with the same objective: to beat the S&P 500 over the longer-term (10 years).

- Adams Financial Concepts (AFC) Managed Accounts results are net of all fees and expenses. The results are net, net, net.

- AFC Managed Accounts do not include the results of the Incentive Profit Sharing Accounts.

- The performance presented is that of actual client accounts and includes all equity Growth Accounts with one quarter or more. These are not hypothetical, models or back tested.

- Portfolios are concentrated in as few as 8 equities. Since William Sharpe received the Nobel Prize for showing there is no significant difference in volatility risk for portfolios of 8-9 stocks as compared to 300 stocks. In other words, AFC subscribes to the Mark Twain philosophy of putting all our eggs in one basket and watching the basket.

- AFC Managed Accounts include capital gains and losses, both realized and unrealized, but do not include the impact of taxes on capital gains.

- “I’m always fully invested. It’s a great feeling to be caught with your pants up” – Peter Lynch AFC accounts are always fully invested.

- AFC accepts that there will be times when there will be periodic losses, setbacks, and unexpected occurrences. Calamitous drops do not scare us out of the market.

- Eugene Fama shared the Nobel Prize in 2013 based on showing fewer than seven percent of professional money managers do as well as their index and fewer still beat the index. “Luck versus Skill in the Cross-Section of Mutual fund Returns”, Eugene Fama and Kenneth French, The Journal of Finance, October 2010