Wealth Creation

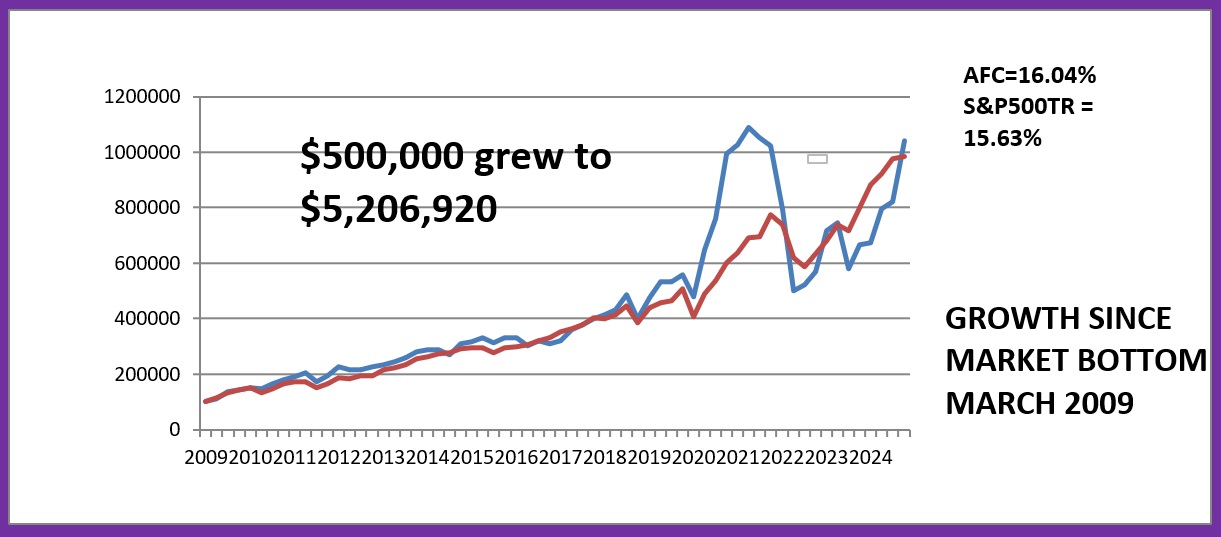

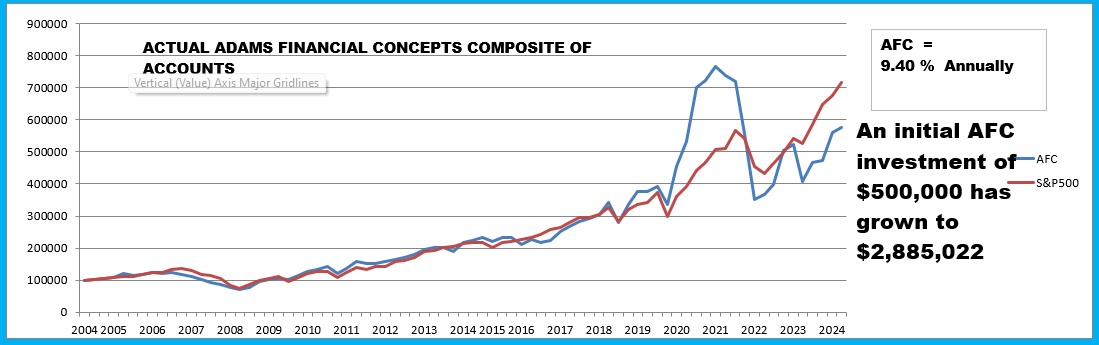

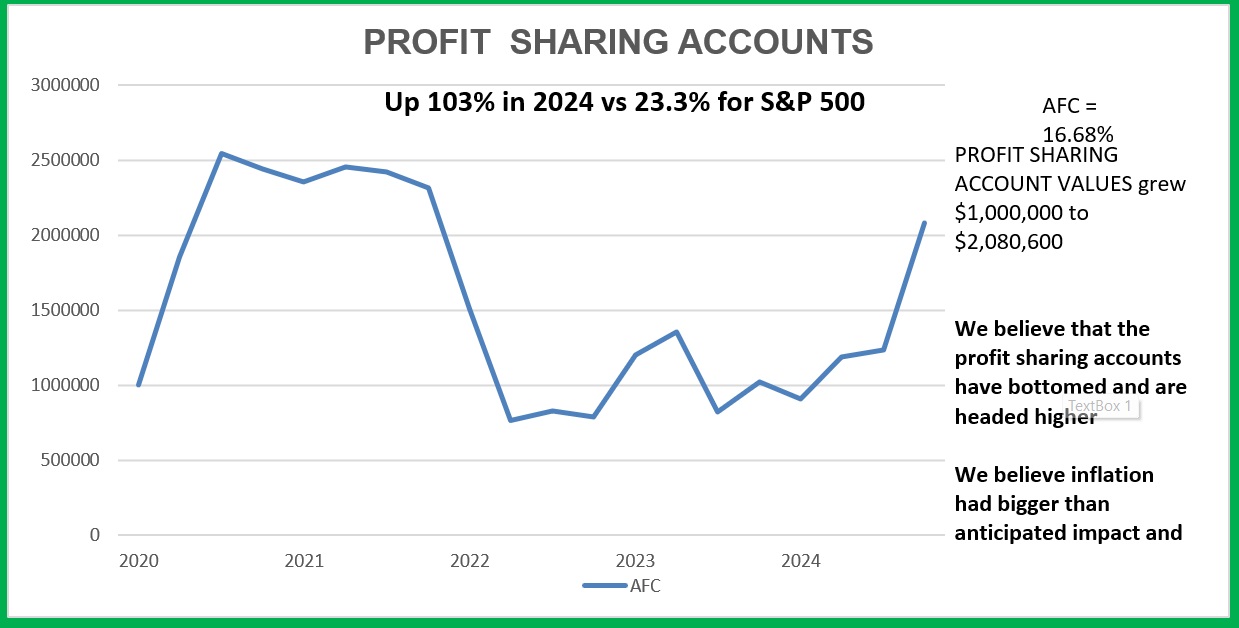

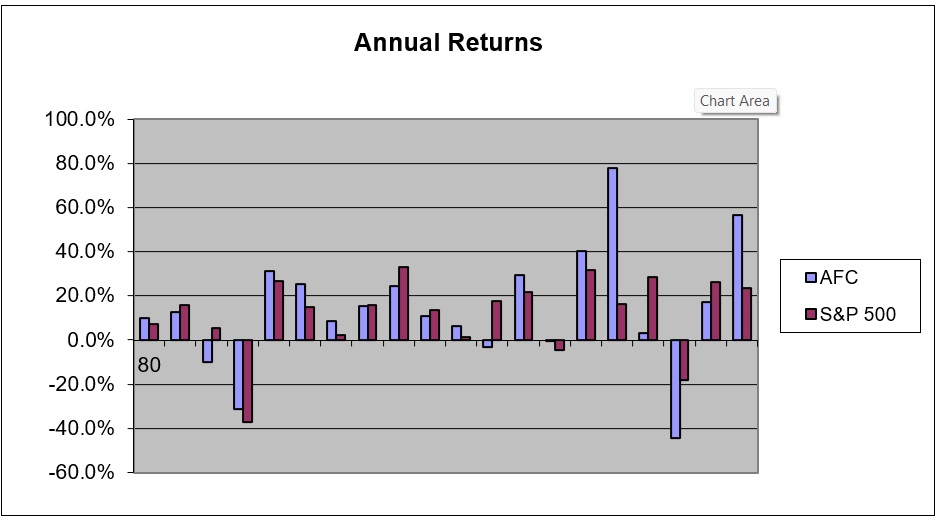

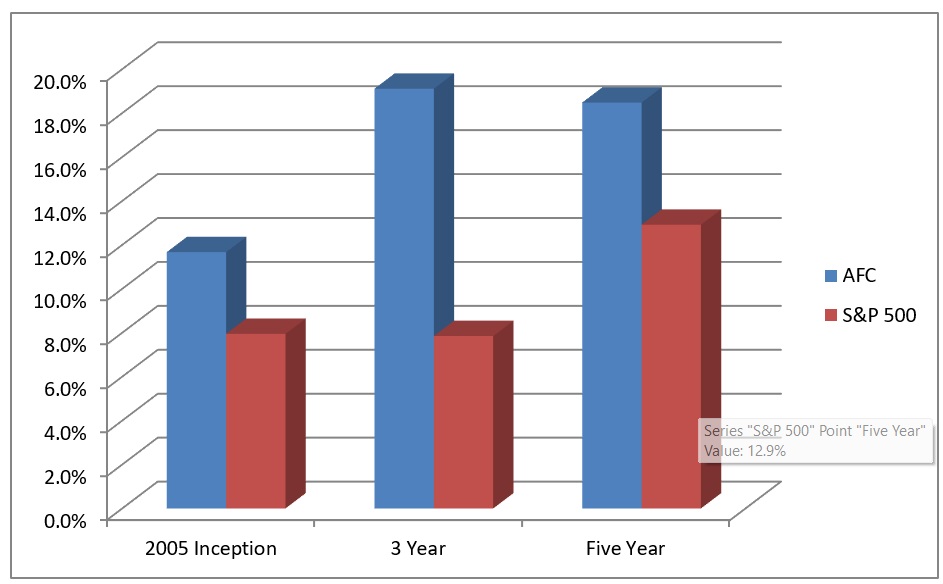

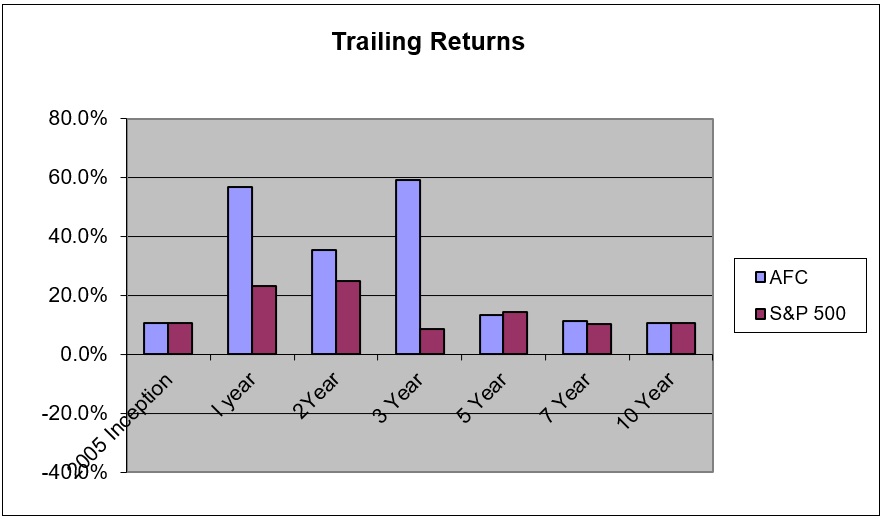

Many firms focus on mitigating risk. Our focus is wealth creation. An 1% increase in annual performance over 25 years will result in a nest egg that is over 20% greater. Think of what 3%-5% in annual performance will do over 25 years.