Our agreement for every client that has a stock account says our goal is to outperform the S&P 500 with dividends reinvested over the longer-term (5 to 10 years). Whether conservative, moderate, or aggressive, that is our commitment in writing and signing. We do that because we believe we are that good. Studies show that fewer than 3% of professional money managers can make that claim1,2. We know of no financial advisor who can make that claim.

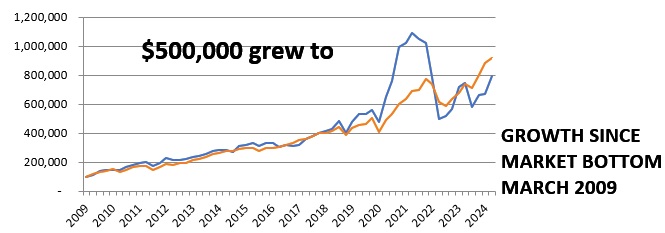

We are once again performing better than the S&P 500TR. At the end of 2023 the composite trailed the S&P 500 for every time period. That was the first time ever. In 2024 the performance of the AFC accounts is once again outperforming and we are guardedly optimist that will continue. We know that there will be times when there will be periodic losses, setbacks, and unexpected occurrences. Calamitous drops do not scare us out of the market. There will be times when we underperform the S&P 500. Over the longer-term, our goal for every stock portfolio is to do better than the S&P 500.

Why do we feel that is an important benefit for our clients? Mike Adams spent over 18 years at large brokerage firms. The mantra was “Sell the relationship, not the performance”. In other words, make the clients like you and disregard how well their accounts values increase or decrease. Studies show the average financial advisor’s clients achieve approximately 5% per year3. The difference between 5% per year and 15% per year is significant. $500,000 invested at 5% will grow to $1,583,177 as compared to a 15% growth to $16,459,476.

| 6/30/2024 | AFC | S&P 500 |

| since 6/30/2009 | 18.4% | 15.3% |

| I year | 7.0% | 24.6% |

| 2Year | 26.1% | 22.1% |

| 3 Year | -9.9% | 10.0% |

| 5 Year | 8.3% | 15.1% |

| 7 Year | 7.0% | 10.9% |

| 10 Year | 7.2% | 10.3% |

Disclaimers:

- Past performance is no guarantee of future performance.

- AFC uses the S&P 500 with dividends reinvested as the comparable index for all accounts.

- AFC Managed Accounts returns include all active accounts as well as all closed accounts with the same objective: to beat the S&P 500 over the longer-term (10 years).

- Adams Financial Concepts (AFC) Managed Accounts results are net of all fees and expenses. The results are net, net, net.

- AFC Managed Accounts do not include the results of the Incentive Profit Sharing Accounts.

- The performance presented is that of actual client accounts and includes all equity Growth Accounts with one quarter or more. These are not hypothetical, models or back tested.

- Portfolios are concentrated in as few as 8 equities. Since William Sharpe received the Nobel Prize for showing there is no significant difference in volatility risk for portfolios of 8-9 stocks as compared to 300 stocks. In other words, AFC subscribes to the Mark Twain philosophy of putting all our eggs in one basket and watching the basket.

- AFC Managed Accounts include capital gains and losses, both realized and unrealized, but do not include the impact of taxes on capital gains.

- “I’m always fully invested. It’s a great feeling to be caught with your pants up.” – Peter Lynch AFC accounts are always fully invested.

- AFC accepts that there will be times when there will be periodic losses, setbacks, and unexpected occurrences. Calamitous drops do not scare us out of the market.

- Eugene Fama shared the Nobel Prize in 2013 based on showing fewer than seven percent of professional money managers do as well as their index and fewer still beat the index. “Luck versus Skill in the Cross-Section of Mutual fund Returns”, Eugene Fama and Kenneth French, The Journal of Finance, October 2010.