Most financial advisors classify their clients by the size and revenues of their accounts. They treat A+ clients better than A clients; A clients better than B clients; and B clients better than C clients. Bigger clients probably get a preference on account returns as well. At Adams Financial Concepts we strive for equal performance for all client accounts. Consider this case study.

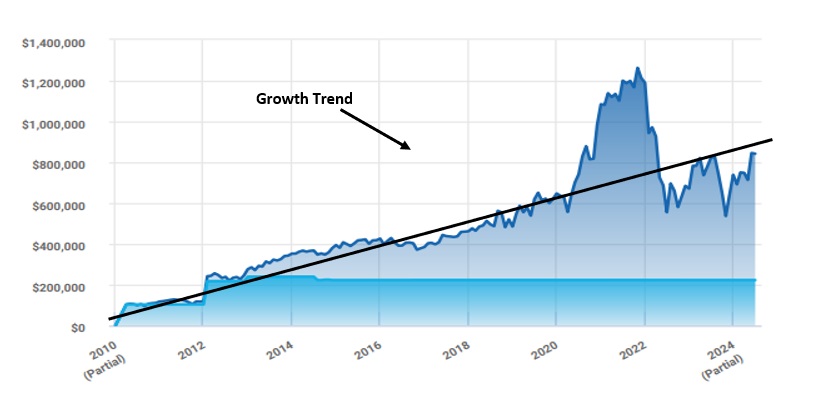

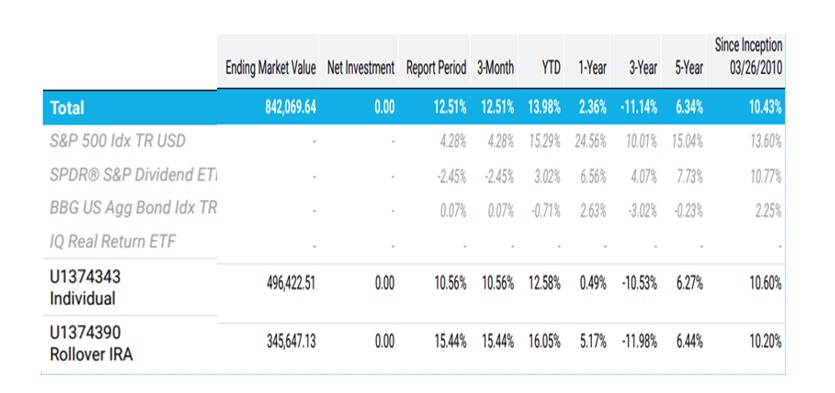

Gloria’s mother did not have an account at AFC but by reputation she recommended that Gloria open a regular account and IRA. Gloria opened one account in 2010 and another in 2012. The total was just over $200,000. With most financial advisors Gloria would have been classified as a C client or might have been rejected not even meeting a $500,000 minimum. Today those accounts are approaching $1 million and growing.

GLORIA’S ACCOUNTS

Not only do we not classify our clients by the size and revenue we do not favor the largest accounts giving them better performance. What follows is a little complicated mathematically, but it has a significant impact on your account return. I do not believe that most financial advisors understand it.

Some years ago brokerage firms, money managers decided on a standard statistical method for reporting performance. The Global Investment Performance Standard (GIPS). In working with two consultants who specialized in setting up GIPS reporting we realized using GIPS favored big accounts to the disadvantage of small accounts.

GIPS calls for using time weighted returns for calculations in determining individual account performance and dollar weighted returns (also known as Internal Rate of Return or IRR) for combining individual accounts into a composite. I believe they have it wrong. The individual accounts should be IRR and the composite time weighted.

Time weighted returns are inaccurate when there is a big increase or decrease in a quarter or when there is a big cash infusion or withdrawal. Here is an example: In year one, a person puts in $100,000 and the account increases 50% to $150,000. Happy with that return the person now puts in $1 million, bringing the total at the beginning of year two to $1,150,000. In the second year, the account drops by 20% to $920,000. By time weighted return, the account performance would be (1.50)X(.8) = 1.20 or an annual return of positive 9.5%. (The square root of 1.20). In fact, the account is negative, not positive. The actual performance is -4%.

GIPS uses dollar weighted returns, IRR, for combining accounts into a composite. The calculation of IRR will weight the larger accounts more than the small accounts. In talking to the GIPS consultants, they said the fiduciary responsibility should govern: Investment managers should spend equal resources on both large and small accounts. I don’t believe that will ever happen.

Consider this example. A investment manager decides to add stock XYZ to portfolios. The manager is able to buy two blocks of 100,000 shares each. One block is purchased at $40.32 and the second block at $40.73. There is a temptation for the manager to give the lower priced shares to the bigger accounts and the more expensive to the smaller accounts. Afterall the bigger accounts count more in the GIPS return than the smaller accounts.

In theory the two blocks should be blended for an average price and everyone should get the same purchase. That is what we do at AFC. But I seriously doubt that happens with other investment managers. Money managers using GIPS have an incentive to favor accounts and the larger the account the more the advantage. They may have a fiduciary obligation but if they do not understand the math…

Gloria’s accounts are moderately conservative and still are approaching a five-fold increase. She is not classified as she would probably be at another advisor. Her accounts are managed in the same way as even smaller accounts and larger accounts that are moderately conservative.

Are yours?

- Past performance is no guarantee of future performance.

- AFC uses the S&P 500 with dividends reinvested as the comparable index for all accounts.

- AFC Managed Accounts returns include all active accounts as well as all closed accounts with the same objective: to beat the S&P 500 over the longer-term (10 years).

- Adams Financial Concepts (AFC) Managed Accounts results are net of all fees and expenses. The results are net, net, net.

- AFC Managed Accounts do not include the results of the Incentive Profit Sharing Accounts.

- The performance presented is that of an actual client account. This is not hypothetical, a model or back tested.

- Portfolios are concentrated in as few as 8 equities. Since William Sharpe received the Nobel Prize for showing there is no significant difference in volatility risk for portfolios of 8-9 stocks as compared to 300 stocks. In other words, AFC subscribes to the Mark Twain philosophy of putting all our eggs in one basket and watching the basket.

- AFC Managed Accounts include capital gains and losses, both realized and unrealized, but do not include the impact of taxes on capital gains.

- “I’m always fully invested. It’s a great feeling to be caught with your pants up.” – Peter Lynch AFC accounts are always fully invested.

- AFC accepts that there will be times when there will be periodic losses, setbacks, and unexpected occurrences. Calamitous drops do not scare us out of the market.

- Eugene Fama shared the Nobel Prize in 2013 based on showing fewer than seven percent of professional money managers do as well as their index and fewer still beat the index. “Luck versus Skill in the Cross-Section of Mutual fund Returns”, Eugene Fama and Kenneth French, The Journal of Finance, October 2010.