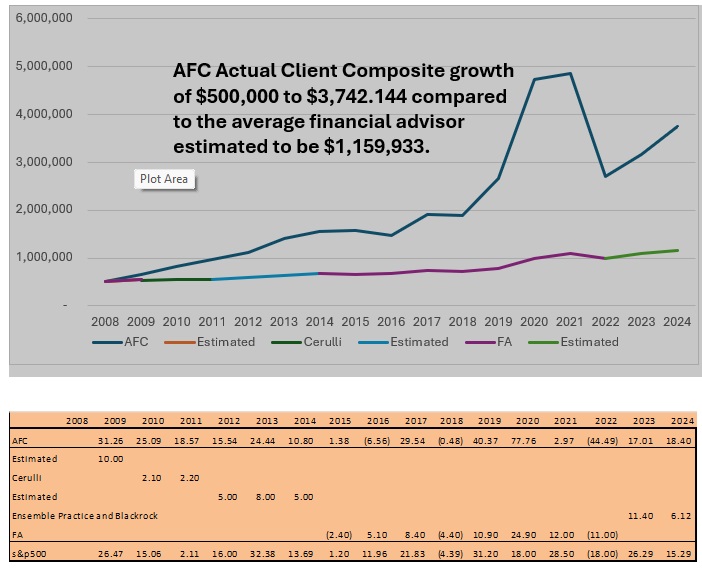

Why does Adams Financial Concepts get such better returns for our clients than most financial advisors? We do. Check out the chart showing how we do compared to the average financial advisor. There is a reason we publish our returns, and most financial advisors do not. They will give all sorts of excuses, but the reality is either they do not know, or they do not want you to know. So, what is the reason? The story of two stocks below demonstrates at least part of the reason.

At Adams Financial Concepts we believe that history does not repeat but that it rhymes. We believe that changes happen in technology, demographics and lifestyles that make the future different from the past. So, we search for a few focus stocks that will benefit or even lead to those changes of technology, demographics or lifestyles.

If you live in or around Seattle, you will remember in the late 1980s and early 1990s almost every street corner and many building lobbies had a coffee cart. There were those outside Seattle who would question why people would pay $3.50 for a cup of coffee when you could get coffee for less than 50 cents.

There was one company that had a vision to build a chain of coffee stores. Of course that was Starbucks. Starbucks issued their public stock in 1996. I bought 200 shares for one client and waited. I knew that Starbucks would do well in Seattle, but my concern was could they repeat their Seattle success in distant locations. I waited to see how well they did as they began to open shops in Portland. When the earnings reports came in several months later, I began to buy the stock at prices of $10 to $12 per share.

When I did that, I had one client who was so upset he moved his account to another stockbroker. He was so convinced that McDonalds coffee competition would crush Starbucks and put them out of business. No matter how hard I tried I could not convince him Starbucks was a change in lifestyles that had significant upside potential. Could I guarantee that? No all I could say to him was that was my best assessment. He transferred his account.

For the rest of the clients who stayed and were with me in 1996-1997 Starbucks was added to their accounts at $10 to $13 per share. Starbucks would split their stock two for one; then three for one; then two for one again. So, for every share bought in 1996 clients had 12 shares.

The rest of the story as Paul Harvey would say: The stock trades at around $100 per share and has for a number of years. $1,000 invested in 1996 turned into $100,000 by the end of 2018 and I have been trimming back selling portions in client accounts.

Could I have been wrong and the client who left been right? Yes. I have been wrong on other stocks. That is the story of the second stock, 3D Systems. This company can manufacture products on a one-by-one basis, unique to an individual or to a system. Every product would be custom made and yet the manufacturing machine was automated. Download a picture and the computer guiding the manufacturing builds to order. It is like having a custom tailor make a suit.

That was the concept. It had almost unlimited potential for eyewear, footwear, furniture, designable things. Put a block of plastic in the machine, turn on the computer and put out the other end the manufactured product. No human input, just the 3 D printer. I started buying around $12 to $13 per share.

3D Systems was manufacturing plastic products, but sales did not meet expectations, so they shifted to metal products. Those manufactured metal product revenues did not meet expectations, so they shifted again. Each time they shifted they changed management. There was no consistency.

Each time they changed management the stock price would tumble down. After the third change of management, I gave up and sold the stock for around $8 per share. I will say that I did not give up quickly on 3D Systems. The stock was in portfolios for three to four years.

These days the stock sells for less than $4 per share. It was a bust.

There is an old saying for making money in the market: “Let the winners run and cut the losers free.” These stocks were not bought at the same time but seemed to be good to illustrate that principle. Both in the beginning seemed to have immense potential and the stocks were bought at about the same price.

There is an idea of “rebalancing” a portfolio. It is the exact opposite of letting the winners run and cutting loose the losers. Rebalancing would be the sell the Starbucks as it rose and use the proceeds to buy more 3D Systems. We do not rebalance. We stuck with Starbucks until a few years ago. 3D Systems is long gone from portfolios.

It illustrates why the clients at Adams Financial Concepts are seeing the increases noted on the graph above. To hear more check out our seminar.

Robert Burns wrote the best laid plans of men often go astray. How do you adjust your plan to accommodate the unknown events? One way is to attend our next seminars:

September 24, 12 noon at Tulio Restaurant. Lunch provided. Valet parking. $15 per person.

October 10 7pm at Tulio Restaurant. Dinner provided. Valet parking. $25 per person.

Respond to this email or call 206-903-1019.