Will you have enough money to retire and not reduce your quality of life? Big question.

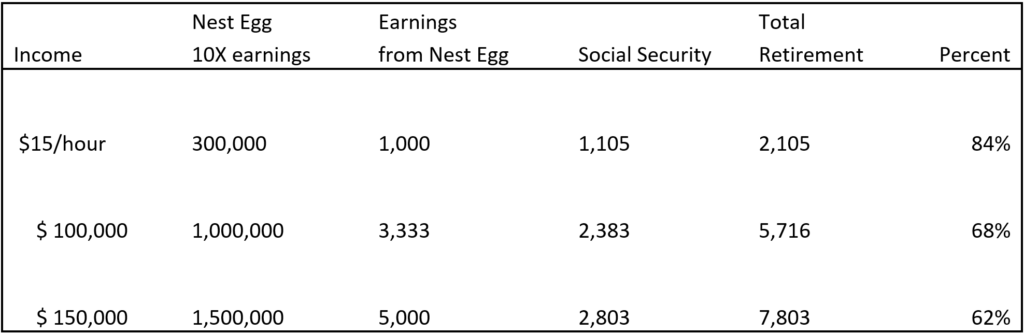

Here is a table that gives some idea of what your nest egg would be at retirement if you had saved ten (10) times your earnings.

Of course, this table must assume the following:

- You will only live to age 85, or you will run out of money.

- You will only need 80% of your income in retirement and that you stay healthy until you die

- Inflation of 3% or less

The accepted wisdom that your nest egg need be only 10 times your current income is based on data collected forty years ago. Notice for a couple with a family income of $150,000 a year, the 10 times figure today furnishes only 62% of current income. There is a significant shortfall, and even at that it means running out of money by age 85!

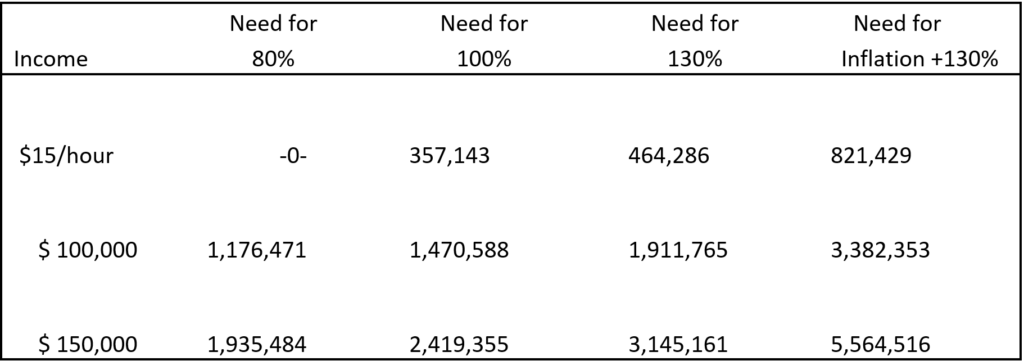

Notice that ten (10) times earnings only works for employees making $15/hour , and it makes dangerous assumptions. Half the people reading this note will live past age 95. Running out of money at age 85 and living for years beyond is not a pretty thought. This means that, in order to afford a longer lifespan and higher medical and transportation costs, we may need as much as 130% of our income. Here is a table showing the nest egg I recommend for different levels of income.

Are you on track to have enough for retirement?

Here is a rough estimate based on your age:

Age 40 – 2-3 times your annual income

Age 50 – 4-5 times your annual income

Age 60 – 6-9 times your annual income

Age 67 – 8-15 times your annual income

How do you stack up?

All of this assumes a withdrawal rate of four percent (4%) per year. The issue is this: the average return of financial advisor managed accounts is just 4%. When there is an unexpected event, like the pandemic or the Great Recession, the assumption is that you will reduce your spending to only take a withdrawal of that four percent. If you take more, that increases your chances of running out of money.

Two times during my career I have met with prospects who felt they were being prudent in their spending and investments. In one case, the retiree realized he needed an average yearly return of 30% to maintain his quality of life. I do well, but not that well. I could not help him.

In the other meeting, it was a widow who had been well provided for when her husband died, but she continued the same level of spending. After a number of years her financial advisor told her she was going to have to cut her withdrawals by 50% to avoid running out of money. The returns in the account were insufficient to keep up her level of spending. However, I was able to help her money outlive her.

While both are extreme cases, many people face this reality every day. Based on the first table of 10 times current income, a number of people are going to feel the pain of those examples.

The point is this: I focus on client account performance. I want my clients to have enough to retire without changing their quality of life and not to worry about running out of money.

How do you stack up?