What would you say if someone offered to pay you $37,000 to just take one single contract for 1,000 barrels of oil? All you had to do is find a place to store it. That actually happened a week ago. All you had to do was figure out where to put ten tanker trucks of oil until the market got better, and you would have been paid to take custody of the oil.

It doesn’t take a rocket scientist to know that demand for oil fell off a cliff. Airlines were cancelling flights and leaving their planes on the ground. People were being ordered to stay home and shelter, and not drive. Factories were being shut down and the workers sent home. The demand for oil had been drying up for a couple months before oil went negative.

Realizing the demand for oil was down and the price was dropping, OPEC’s oil ministers set up a meeting with Vladimir Putin on March 6 to discuss cutting production. Russia depends on oil to furnish half of government revenues. The cost of oil production in Russia is $42 per barrel, and oil prices were already down to $45. The oil ministers wanted to discuss cutting production.

Putin walked out of the meeting. Doesn’t he sound like a spoiled child? When he doesn’t get his way he walks out. Saudi Arabia decided to punish Putin, and they realized they could kill two birds with one stone. Saudi Arabia decided to increase production to drive the price of oil down to $10 per barrel.

The United States, for decades, bought oil on the open market from Saudi Arabia and other oil producing countries. But since companies began fracking, the United States has become an exporter of oil rather than importer. Saudi Arabia, by cutting the price to $10 per barrel, could not only punish Putin but also the frackers in the United States. $10 per barrel oil equivalent is below the operating cost of frackers. Most are highly in debt and within days, US fracking firms began to file for bankruptcy.

But the lower price did nothing to improve demand. Countries were still shuttering their factories, their small businesses, their workers. So on last Monday the 20th, someone panicked and realized they owned contracts requiring them to take thousands of barrels of oil and they had no place to put the oil. They were willing to pay $37 per barrel for someone to take the oil off their hands.

Oil and gas stocks are dragging the S&P 500 index down. That is why I do not own the index for clients and why I like to pick individual stocks that I can evaluate and determine if they will be affected by the pandemic or the fallout from the pandemic – like oil demand.

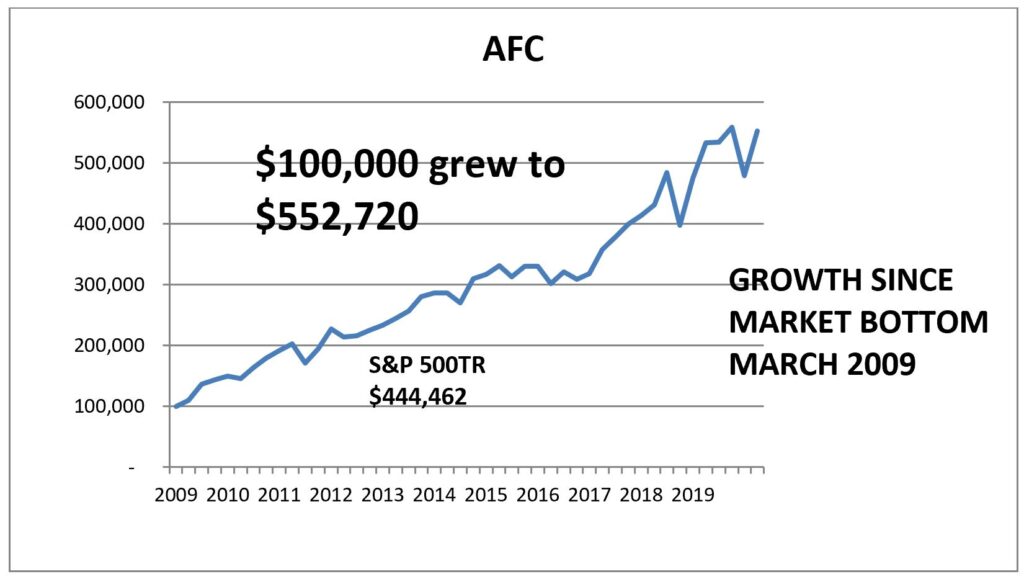

That brings me to this: at the end of the first quarter, all of my client accounts were down. But as of last Friday most were either back to their December 31, 2019 level or slightly above. My clients have financially survived the pandemic and are looking for new highs in their accounts in the not too distant future.

I have to say the quarterly results are compiled by Morningstar. The data in this graph was my reading of client data from Interactive Brokers. I believe it to be accurate, but it is not third party. Converting the AFC Growth Account to the Incentive Profit Sharing Account in the first quarter of 2020 would mean the account would have been $658,023 as opposed to the Growth Account $552,720. Of course past performance is no guarantee of future performance. Please see our website for all the notes and disclosures on performance.

Check out the difference between the AFC Growth Account and the S&P 500 with dividends reinvested. Also check your account against this. Are you fully recovered and expecting new highs in the not too distant future?