Our goal here at AFC is to be better, not bigger. Financial Advisor Magazine ranks the top firms by assets under management. What counts for us at AFC is how those client accounts are performing. In 2020, the S&P 500 TR ended the year up 16.3%; this is our benchmark. The agreement that we sign with each equity client states in writing that our objective is the do better than the S&P 500. We believe that this metric is a better assessment of value delivered to the client – not assets under management.

In 2020, a client account managed by one of those top-100 managers (again, ranked by asset class) returned on average only 3.7% to their investors. The growth of those firms was nearly 20%. For me, this indicates the goal of the firms is asset accumulation by bringing in new clients, not seeing those client accounts grow. There could be any number of mitigating factors, of course, and 2020 was just one year – and an unusual one due to the pandemic.

I have seen the same pattern year after year. The firms are growing assets, but not with a focus on their client’s returns.

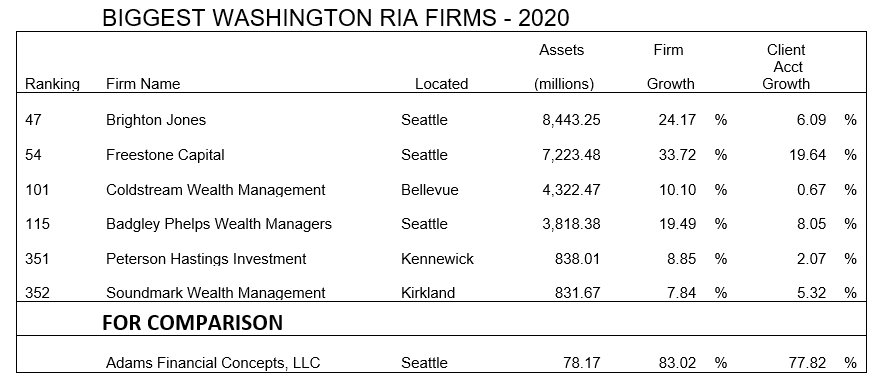

Check the table below. There are 433 firms with $500 million or more in assets on the Financial Advisor magazine list. Six of those firms are located in Washington state. Note the growth of each firm versus the growth of the client accounts. The difference is considerable. The numbers do not lie: when firms put their emphasis on growing bigger by new client acquisition instead of by growing client accounts, it shows clearly.

At AFC, we are growing as well. But the primary focus is on client account growth and will continue to be. 93% of the growth at AFC came from growth in client accounts while only about 36% of the growth at big Washington firms came from client account growth. Clients really have a choice: do they want bigger or better?

We have a passion for creating and maintaining wealth. We have just been through a pandemic – a black swan event that no investment manager I know ever expected.

The rapid recovery of the market in 2020 was exceptional. Don’t count on a repeat during the next big sell off. Instead, plan for a “Margin of Safety” in your portfolio.

The bounce-back of 2020 is the shortest on record. Most market recoveries take a lot longer. If counted in inflation-adjusted terms, the drop that began in 1966 did not recover for 30 years. Stocks hits 1,000 on the DOW in 1966 and then bounced up and down for 16 years before finally reaching new highs. But inflation roared during that time and devalued the dollar by 70%. It took three times as many dollars on the average to buy the same goods in 1982 as it did in 1966. If the effect of inflation is included, the full recovery from the market peak in 1966 was 30 years.

The 2020 peak to full recovery was 140 days. Prior to that, the shortest period of recovery was 310 days. The average was 1,542 days (4 ¼ years). Not counting inflation, stocks took 30 years to recover from the beginning of the Great Depression in the 1930s.

At AFC, we want client accounts to be prepared to weather the black swans down the road. We are not counting on recoveries like that of the pandemic. While we cannot guarantee it, our goal is that our client accounts grow to the point they can weather years long or even decades long malaise in the market and economy.

Right now, if your account is sloshing along like most of those at the big firms, it may be time to look for an advisory firm which places the emphasis on your account growth, not on the firm’s growth. The numbers do not lie. Find a firm and advisors who want better, not bigger.