For many portfolio managers, 2023 appeared to be a rare trading opportunity, a slam-dunk, can’t-miss prospect. The Federal Reserve had been raising rates, and it was assumed that trend would continue. The yield curve was inverted, meaning that short-term treasuries were paying more in interest than long-term. Silicon Valley Bank collapsed and further collapses seemed almost inevitable.

That appeared to be the perfect setting for that can’t-miss trade. Buy short-term treasuries at a 5% yield and sell stocks, waiting for the recession to crush prices. The stock market gurus who manage billions of dollars of investor assets were as sure of that gambit, it seems, as Albert Einstein was sure of the speed of light.

Albert Einstein stated the speed of light, measured in a vacuum, is constant; it is always going to be the same. The laws of physics do not change. When there is an action, there will be an equal and opposite reaction, and that is constant. You can be sure that if you stand in your driveway and throw a 10-pound steel ball up 10 feet, it will come back down. There are laws of physics and chemistry and biology that are constant and will never change.

I was a speaker at the 7th Annual Northern California Wealth Forum. As I listened to the portfolio managers essentially recount the reasons they had sold stocks to buy short term treasuries (cash), I realized they were confident in their assessment of that can’t-miss trade. They were 15%, 30%, or even over 50% in cash and short-term treasuries. They seemed to be as confident of stocks plunging and short-term bonds holding up as Einstein was sure of the speed of light.

Wouldn’t it be nice if economics was the same as physics? Wouldn’t it be nice if we could count on a recession when the Federal Reserve was raising interest rates? Wouldn’t it be nice if we could count on stocks dropping in value when the yield curve was inverted? Wouldn’t it be nice if the stock market would plunge when there was concern about banks failing? Wouldn’t it be nice if economics was governed by scientific law, like physics, chemistry, and biology?

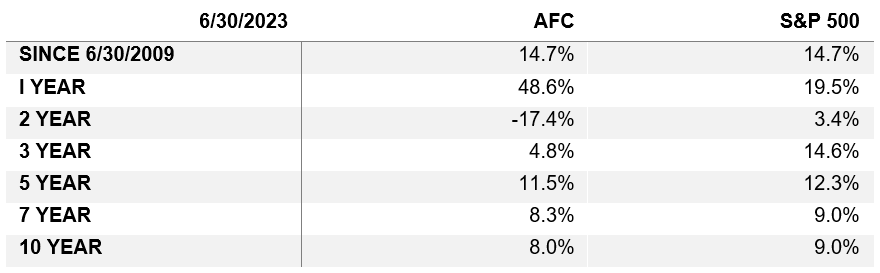

As we finish the second quarter of 2023, I wonder if any of them changed their minds. After all, they made 2.5% for six months. But, had they just invested in the S&P 500 with dividends reinvested, they would have returned 16.89%. Stocks did not cave in when the Fed raised rates, nor as the yield curve remained inverted, nor as a few banks went under. Those portfolio managers missed one of the better moves in stocks.

The reality is that economics is not a science. Making money in the stock market is not about the Laws of Economics. If that was true, the person with the largest computer would always win. Making money in the stock market is an art, not a science. It is realizing that just because the Fed raises rates, or the yield curve inverts, a recession is not inevitable. It may correlate, but there is no law of economics that says it must happen.

The stock market is made up of millions of people with different backgrounds, education, psychology, and experiences making different decisions.

We keep saying that things which have never happened before happen all the time. This seems to be one of those times. We have been warning about inflation since 2016, and we believe it will remain here for a number of years. There are six million more jobs in the United States than there are workers to fill those jobs. Recessions happen when there are fewer jobs than people to fill them. Wages decline during recessions. People slow down or quit spending money on restaurants and clothes and vacations.

But that is not happening. Wages are increasing. People are increasing their spending on restaurants, cars, and vacations. Prices may be rising, but people keep spending. As long as that continues, there will not be a recession.

Instead, company profits will continue to climb, and stock prices will continue to increase. Those investors stuck in short-term bonds will continue to get their interest payments, but they will probably forego bigger gains in the stock market.

We could always be wrong about the future, of course. But so far we have been right on inflation and on the absence of a recession. At this point, we do not see enough evidence for us to change our mind.

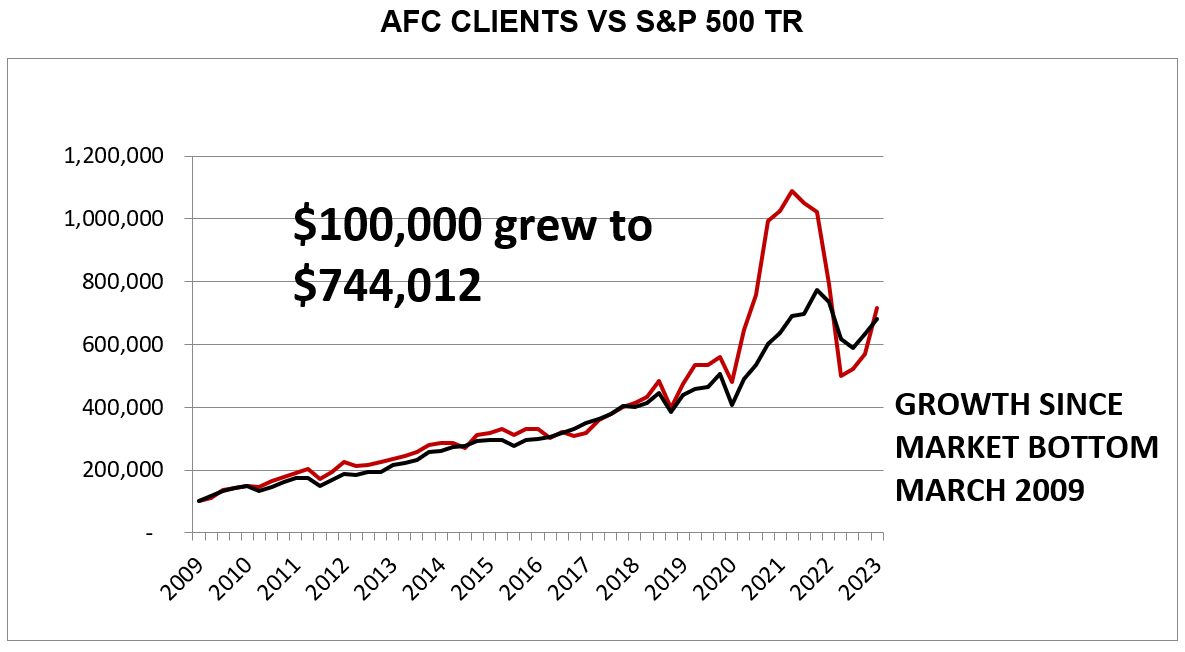

As a final comment: our client account values dropped more than the S&P 500TR in 2022, but those accounts are now climbing faster than the S&P 500TR. For the last 12 months the composite of our client accounts has increased 48.6% as compared to 19.6% for the S&P 500 TR. We are guardedly optimistic about the future.

Notes:

- Past performance is no guarantee of future performance.

- AFC uses the S&P 500 with dividends reinvested as the comparable index for all accounts.

- AFC Managed Accounts returns include all active accounts as well as all closed accounts with the same objective: to beat the S&P 500 over the longer-term (10 years).

- Adams Financial Concepts (AFC) Managed Accounts results are net of all fees and expenses. The results are net, net, net.

- AFC Managed Accounts do not include the results of the Incentive Profit Sharing Accounts.

- The performance presented is that of actual client accounts and includes all equity Growth Accounts with one quarter or more. These are not hypothetical, models or back tested.

- Portfolios are concentrated in as few as 8 equities. Since William Sharpe received the Nobel Prize for showing there is no significant difference in volatility risk for portfolios of 8-9 stocks as compared to 300 stocks. In other words, AFC subscribes to the Mark Twain philosophy of putting all our eggs in one basket and watching the basket.

- AFC Managed Accounts include capital gains and losses, both realized and unrealized, but do not include the impact of taxes on capital gains.

- “I’m always fully invested. It’s a great feeling to be caught with your pants up.” – Peter Lynch AFC accounts are always fully invested.

- AFC accepts that there will be times when there will be periodic losses, setbacks, and unexpected occurrences. Calamitous drops do not scare us out of the market.

- Eugene Fama shared the Nobel Prize in 2013 based on showing fewer than seven percent of professional money managers do as well as their index and fewer still beat the index. “Luck versus Skill in the Cross-Section of Mutual fund Returns”, Eugene Fama and Kenneth French, The Journal of Finance, October 2010.