On Monday, June 14, 1986, the Dow Jones average dropped 45.75 points in one day, setting a record. It recovered 36 points on Tuesday to 1,874. That was the month in which I licensed to be a stockbroker, and so at the time I was cold calling to build my book of clients. I made one notable call to a prospect who had sold to cash. He claimed he would open an account with me, but he refused to invest until the DOW hit 1,300. We spoke several times, and I gave him dozens of reasons to invest immediately. He absolutely insisted on holding out for 1,300. I quit calling and do not know if he ever invested. But I do know this: the DOW never fell to 1,300. Instead, for the last 35 years it has soared to over 30,000! Even on Black Monday, when the market sold off a record 22% in one day, the DOW never dropped all the way down to 1,300.

Over the course of the 20th century, we experienced many ups and downs including the Great Depression and numerous recessions. There were two world wars, dozens of smaller conflicts like Korea and Vietnam, and of course the “Cold War” with the Soviet Union. Two United States Presidents were assassinated and five nuclear melt downs occurred, including the Chernobyl Disaster and the Three Mile Island Nuclear Accident. The Nuclear Arms Race began, despite the evidence of atomic devastation in Japan. Yet regardless of a century packed with unexpected disasters, on January 1, 1900, the Dow began at 66 points and ended the century at 11,467!

Today, there are those investors sitting on the sidelines waiting for the DOW to drop to “1,300 Points” or whatever their metric may be. They are waiting for the capitulation of the market. Yet they have forgotten an important adage for investors, “The risk is being out of the market, not in it.”

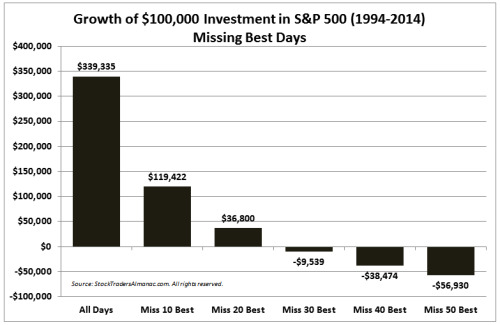

There are any number of studies which show that being in the market through the ups and downs is the winning strategy.

Missing just the ten best market days over a 20 year time period reduced the growth of a theoretical portfolio from over 339% to just 19%! That is the issue with thinking that you can capitalize on the “perfect” moment to enter the market.

AFC accepts that we will experience periodic losses, setbacks, and unexpected events. Calamitous drops do not scare us out of the market. It’s not that we like them, but we accept that they are inevitable. In the past, we have found that past riding through the down times has allowed us to capitalize on the market upturns. This has been our winning strategy.

We also believe in the old saying of “buy low and sell high”. For those out of the market, now is a good time to get in.

To this day, I still wonder if that prospect from the 1980s is still waiting for 1,300. Are you the reader waiting for your 1,300?