If you knew a money manager that had achieved an average 29% annual return for 13 years, would you believe that the average investor who invested in his fund lost money? It may be hard to believe, but it is true. Peter Lynch, one of the top money managers in history, achieved that return with the Magellan Fund. Fidelity did a study and found the average investor in Magellan actually lost money.

I shared that with a client this past week, and my client revealed that he had been one of those investors who lost money in Magellan. How did that happen? When the fund was down, the client sold out, worried that the fund would continue down. When the fund had recovered to new highs, he reinvested only to sell again when the fund was down.

It is human nature to fear that a fund or portfolio that has outperformed will return to the average by underperforming for some period of time. Emotions can be our worst enemy when it comes to investing. The founder of Vanguard said in his 50 years in the business he knew of no one, nor did he know of anyone, who had ever known of anyone who consistently outperformed the market by buying and selling.

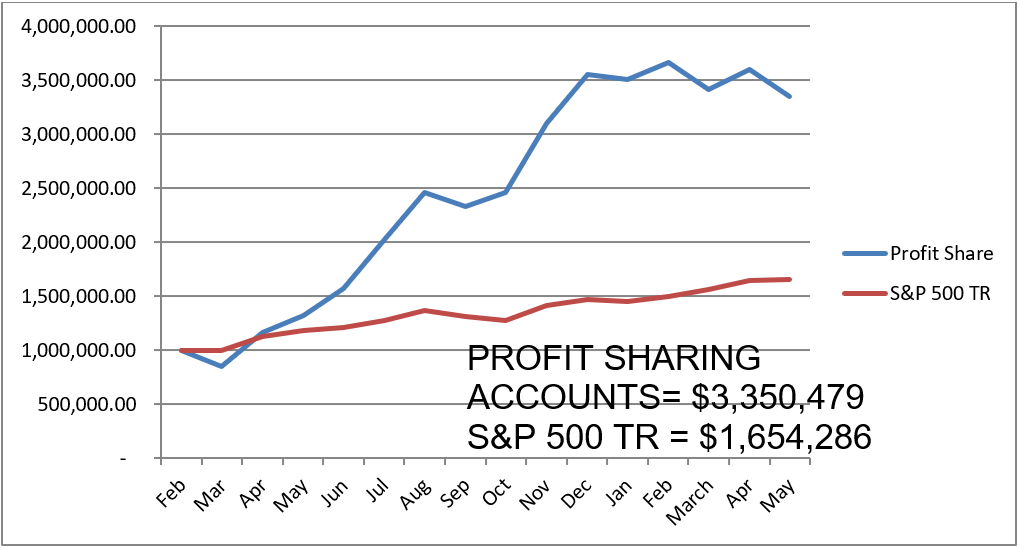

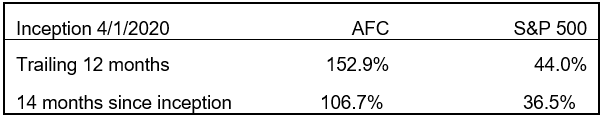

Which brings me to the returns in the Incentive Profit Sharing account, and an estimate of the Growth Accounts. After excellent out performance in the past 12 years and especially in the last 2 years, the returns in 2021 are trailing the S&P 500 TR. The composites of the Growth Accounts were up 40% in 2019 and 77% in 2020 and the Profit Sharing Accounts were up 241% in 2020.

In my opinion this is the time to buy in. The old saying is “buy low and sell high”.

While the S&P 500 TR at the end of May 2021 was up 11.90%, the Growth Account composite was up, by my estimate, 2.03%, and the Incentive Profit Sharing accounts were down 5.6%. I am guardedly optimistic that now is an excellent time to invest in both.

The benefits to you are simple:

- Customized to you – unique to you and your specific needs and risk tolerance.

- 15-year track record of high performance on long-market accounts

- Minimizing Risk

- Tax Efficient

- No fee – just profit sharing on the $1 million account

- Classified as a Conservative, not High Risk, Account

Notes:

- Adams Financial Concepts (AFC) Incentive Profit Sharing (PS) Accounts results are net of all costs and expenses. The results are net, net, net.

- AFC Incentive Profit Sharing Accounts are not appropriate for qualified accounts. The structure of PS accounts requires leverage for both the long and also requires short positions. Neither leverage nor shorting is permitted in qualified accounts.

- AFC PS Accounts returns as of February 1, 2020 include all active accounts as well as any closed accounts. As of the date of this note there have been no accounts closed.

- The objective for all AFC PS and Managed Growth Stock Accounts in these tabulations have a common objective: “Beat the S&P 500 over the longer-term (10 years)”.

- AFC PS Accounts are concentrated in 8 to 12 securities on the long side and concentrated on the short side as well. Concentration may increase volatility.

- AFC PS Accounts include capital gains and losses, both realized and unrealized, but do not include the impact of taxes on capital gains.

- Minimum Account Size: Per Washington State Code WAC 460-24A-150 There has to be $1 million USD under management with AFC which can be split between both PS and Growth Accounts. In addition, client must have a net worth of $2.1 million USD excluding home.

- Past performance is no guarantee of future returns.

- S&P 500 Index includes dividends reinvested.

- This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities or to enter into any investment advisory relationship and may not be relied upon in connection with any offer or sale of securities.

- “Luck versus Skill in the Cross-Section of Mutual Fund Returns” published in The Journal of Finance, October 2010 by Eugene Fama and Kenneth French,

- Structure of the accounts is based on the book: The Prudent Investor’s Guide to Hedge Funds by James R. Owen, published 2000.