Check our results; we have been saying that market bottom likely occurred on October 12, 2022. Nothing since has convinced us otherwise. At AFC, we believe that stocks have a value and a price. Value is what a share of stock is worth and price is what people are willing to pay for that share of stock. Bernard Beruch said it originally, and Art Cashin has since paraphrased, “The stock market is a perception market. When people believe that “2 +2 = 5” they will pay 4 ¾ all day long.” My corollary is that when people believe “2+2=3”, what they paid 4 ¾ for they will sell for 3 ¼.

AFC looks at the value of companies and their shares over the longer-term, and we tend to buy early, before share prices are pushed up. We are looking for prices that are below the value of the company. In 2020, it seemed a lot of people understood the value of the stocks we held in client portfolios and that pushed the prices up dramatically. Yet AFC still felt there was more value in each of the positions. However, as the Fed began to raise rates, the “2+2=3” mentality returned, our stocks fell pretty dramatically.

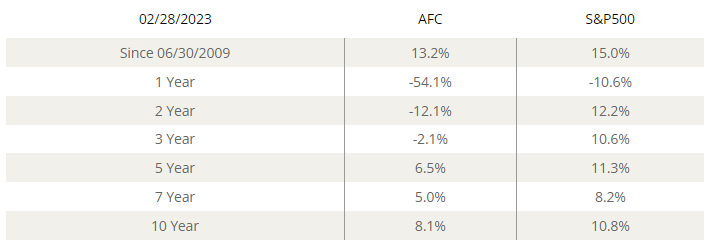

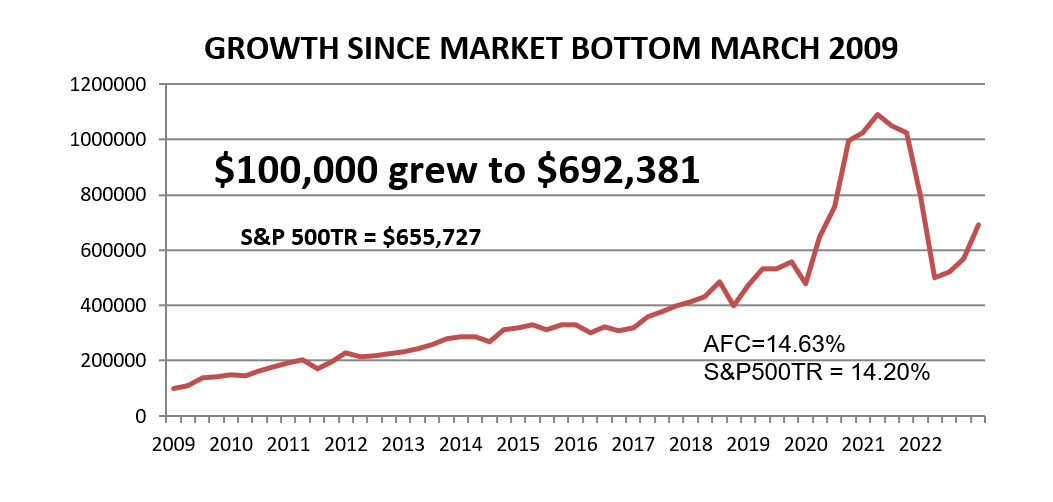

What appears to be happening now is that investors are beginning to remember that “2+2 = 4” once again, and our client portfolios are rising in correlation. AFC portfolios are gaining more rapidly than the S&P 500 with dividends reinvested. Look at the numbers. Our managed growth portfolios increased by 29.9% in the first two months of 2023 compared to 3.7% for the S&P 500 TR. Yes, we were down more during 2022 than the S&P 500, but we have historically recovered more rapidly than the market as well. Of course, past performance is no guarantee of future results.

We cannot be sure how long it will take for our clients to see their accounts hit new highs, but we are guardedly optimistic it is going to be sooner than most of the so-called gurus expect. And for those who are not yet clients, it is time to “buy low” so you can “sell high”.

The composite consists of actual client accounts without any carve-outs. The composite includes all clients with at least one full quarter at AFC; clients who had accounts prior to 2009 and all terminated accounts for as long as the client was at AFC. Most terminated accounts are those of clients who have passed away. Past performance is no guarantee of future results.