Every contract to manage client money states that our objective is to beat the market (S&P 500 with dividends reinvested) over the longer-term (5 to10 years). How have we done? At the end of 2020, we provided each client a comparison of how their account, with all of their life events and withdrawals, would have done invested in the S&P 500 versus under our management. We compared 112 stock accounts with more than a quarter in our care, 111 beat the benchmark The one account that did not do better than the S&P 500 TR is an older client with a very conservative, bond-based portfolio.

Why is that a benefit to our clients? I believe the answer is simple. If there is a black swan event, like a pandemic or a Great Recession, wouldn’t you rather have $5 million than $1 million? We believe in the importance of financial security.

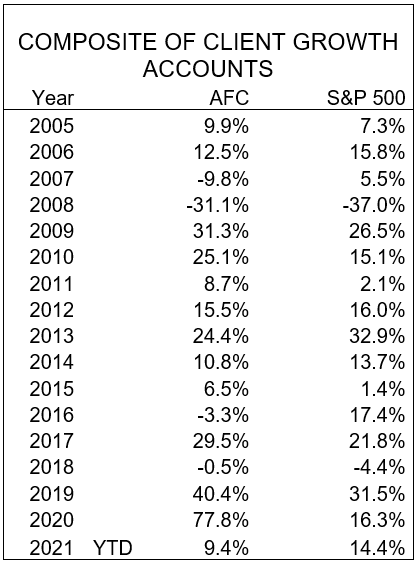

Even though all but one client had performance in their accounts that exceeded the S&P 500 TR at the end of 2020, this year performance is lagging somewhat. Through June, the growth accounts were up 9.4% and the profit-sharing accounts were basically flat for the first six months. It is not unusual for that to happen. There are years when the growth accounts underperform.

Check out our real returns, net of fees, as compared to the S&P 500TR. In 2007 the growth accounts underperformed by over 15%, however, within three years the growth accounts had recovered and surpassed the S&P. That happened again in 2016 when the growth accounts lagged by over 20%. By 2019 and 2020 the growth accounts had outperformed the S&P 500.

The pattern is clear. There can be no assurance it will happen again, past performance is no guarantee of future results, but I am guardedly optimistic that the pattern will hold. I choose the holdings in our clients’ accounts because I believe they will add value regardless of what happens to the overall market.

One more observation I want to make is this: excepting a single account, all the accounts exceeded the S&P 500TR. Whether the accounts were opened and invested at a high or low point in the market, they all surpassed the S&P.

To put that in perspective, Eugene Fama, who shared the Nobel Prize in 2013, did a study that showed fewer than three or four percent of professional money managers exceeded their benchmark.1 A Standard and Poors study showed the same.2

Of course, I always have to say that past performance is no guarantee of future performance.

We have a passion for creating and maintaining wealth for our clients, and if you are reading this, you can see the numbers. It is not just talk. It is not a model portfolio. These results are not back tested. They are not hypothetical. This is the composite of all client equity growth accounts. It includes all accounts that have been opened at least one quarter and those accounts which terminated.

I have been managing money for over 30 years and it seems to me like a good time to start a new account with AFC if you do not have one now. After all, isn’t the saying “Buy Low, Sell High” to make money?

Notes:

- “Luck versus Skill in the Cross-Section of Mutual fund Returns”, Eugene Fama and Kenneth French, The Journal of Finance, October 2010.

- “SPIVA US Scorecard”, Aye Soe and Ryan Poirier, S&P Dow Jones, 2018.