There are two strategies that many brokers suggest to investors for a secure retirement. First, to put your money away in a ROTH IRA. Second, to avoid losing money you should diversify your portfolio into different asset classes.

I believe that we need to examine these common strategies and reassess if they are benefiting investors, or not.

Beginning with the ROTH IRA. The ROTH has such appeal. I would guess your advisor or even CPA will tell you that if you pay the tax on your investment upfront, you will get to withdraw all of the original investment plus all the growth tax free. Theoretically, with a ROTH IRA, by paying a smaller amount of taxes upfront, investors will avoid paying additional taxes in retirement. But does it?

If tax rates remain the same from when you deposit the investment in the ROTH during your career to when you retire, it does not matter if you do the ROTH or a Regular IRA. But if your tax rate has increased when you begin to withdraw money after age 59, the regular IRA is the better deal.

Here’s why.

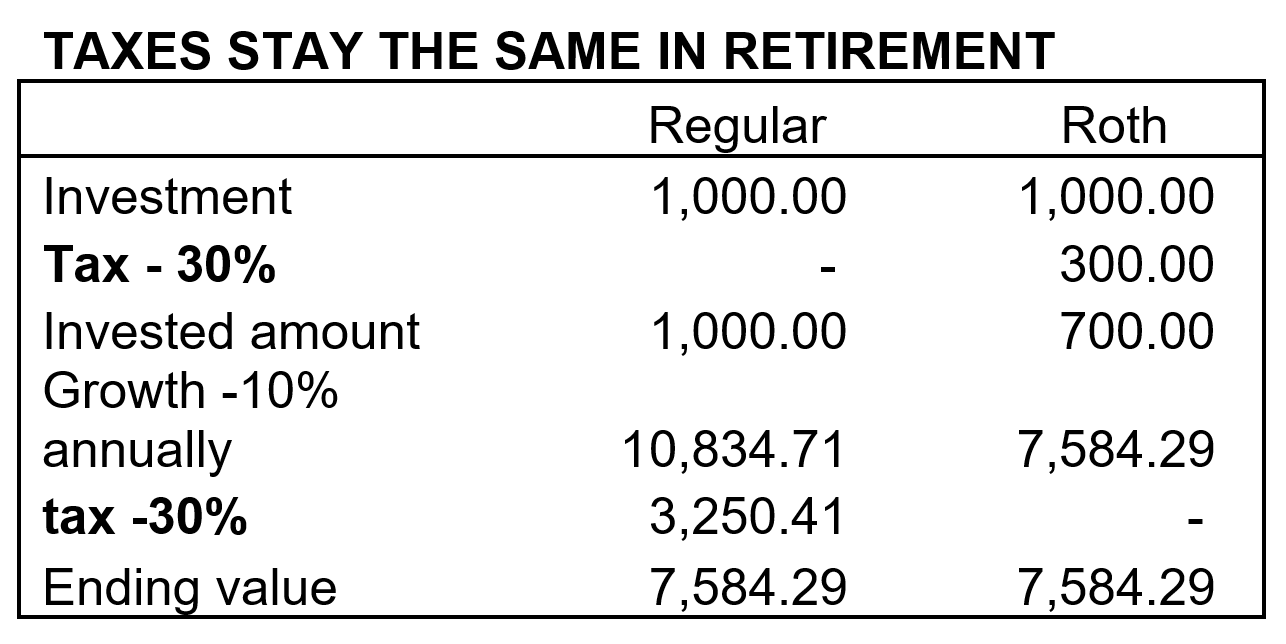

I like math, so let’s show our work. Starting with $1,000 and a marginal tax rate today of 30% and assuming the tax rate will be the same in ten years when you begin to withdraw funds…

If tax rates are the same when you begin to make withdrawals, there is no benefit to having invested in a ROTH IRA.

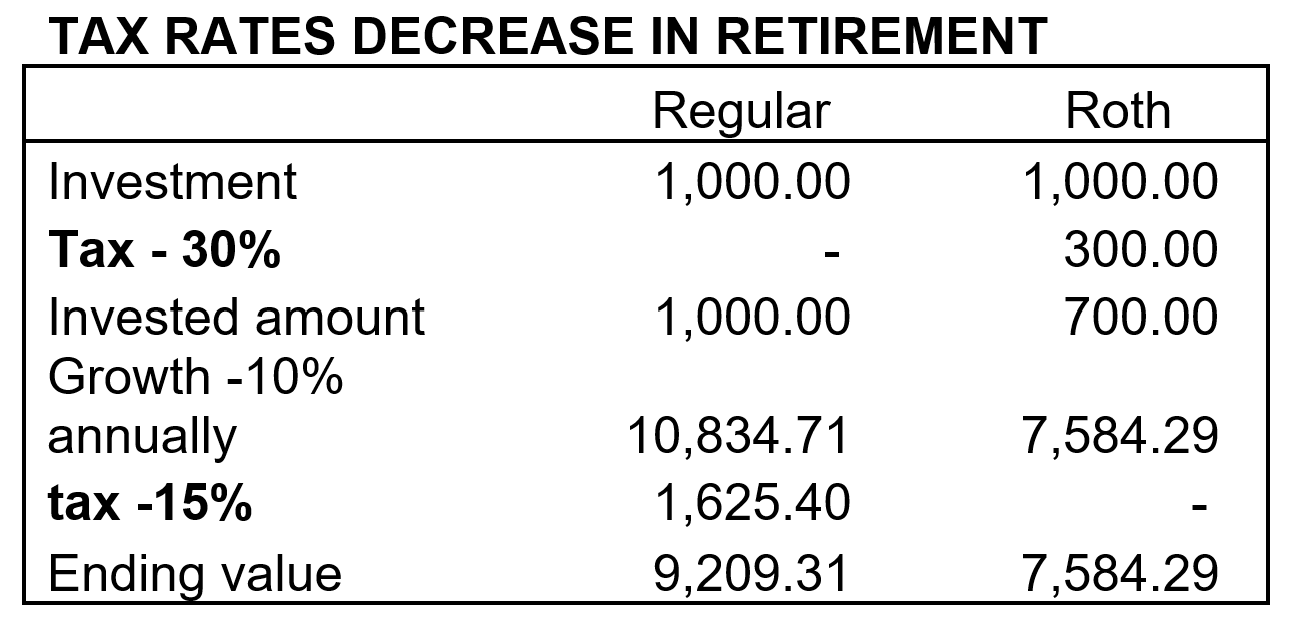

However, if your marginal tax rate decreases when you make withdrawals, the regular IRA is actually the better deal.

Historically, tax rates have declined for most retirees as their income from work has decreased or stopped. Whether that will be the situation in the future or not is anyone’s guess.

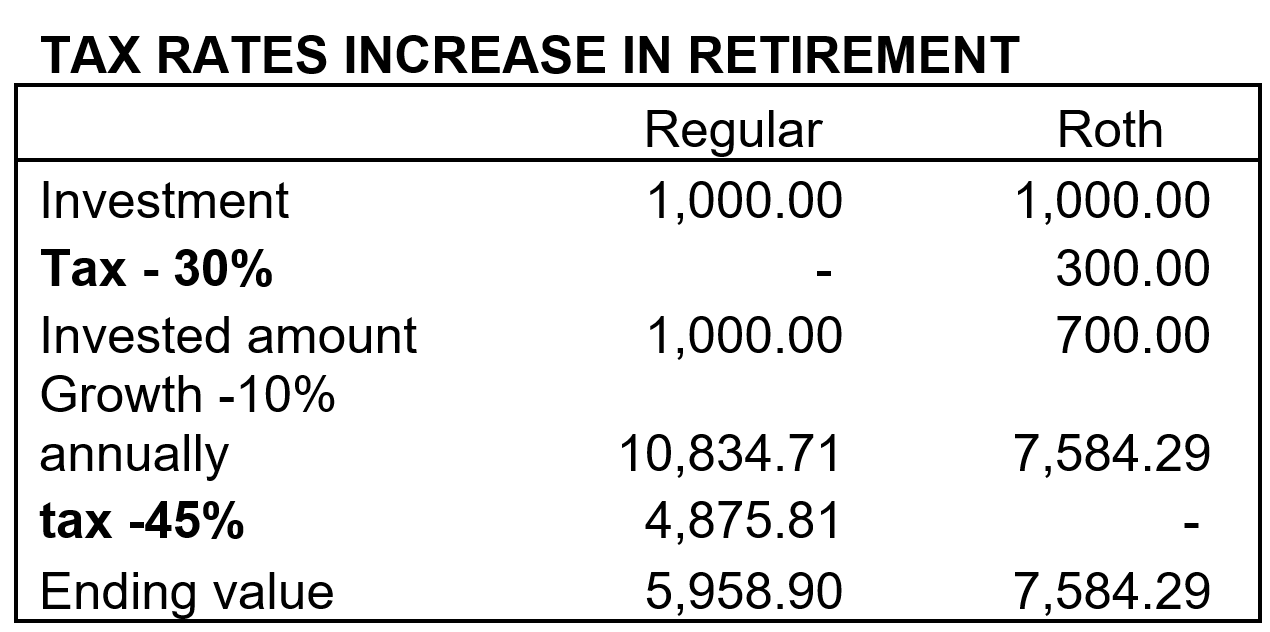

The point is this: tax rates will make a difference, and the difference could be very significant.

For younger workers whose current tax rate is now at the low end of marginal rates, the ROTH is probably the better decision in the short term, but in the long term they, too, will also eventually want to invest in a Traditional IRA as well.

It is for you to figure out if you expect higher or lower tax rates when you retire. It is, in my opinion, a very important decision.

Secondly, by investing defensively, investors may actually be losing money. When I was working for the large and regional brokerage firms, they pushed the mantra, “Sell the relationship, not the performance.” The firms wanted their clients to so like their financial advisors that they would not care about how well their accounts performed. The advisors were simply told not to lose clients’ money. It is a defensive posture. It is also meant, in my opinion, to keep financial advisors and financial service firms from being sued. In my opinion, the focus is on protecting the firm and the adviser, not making money for the client.

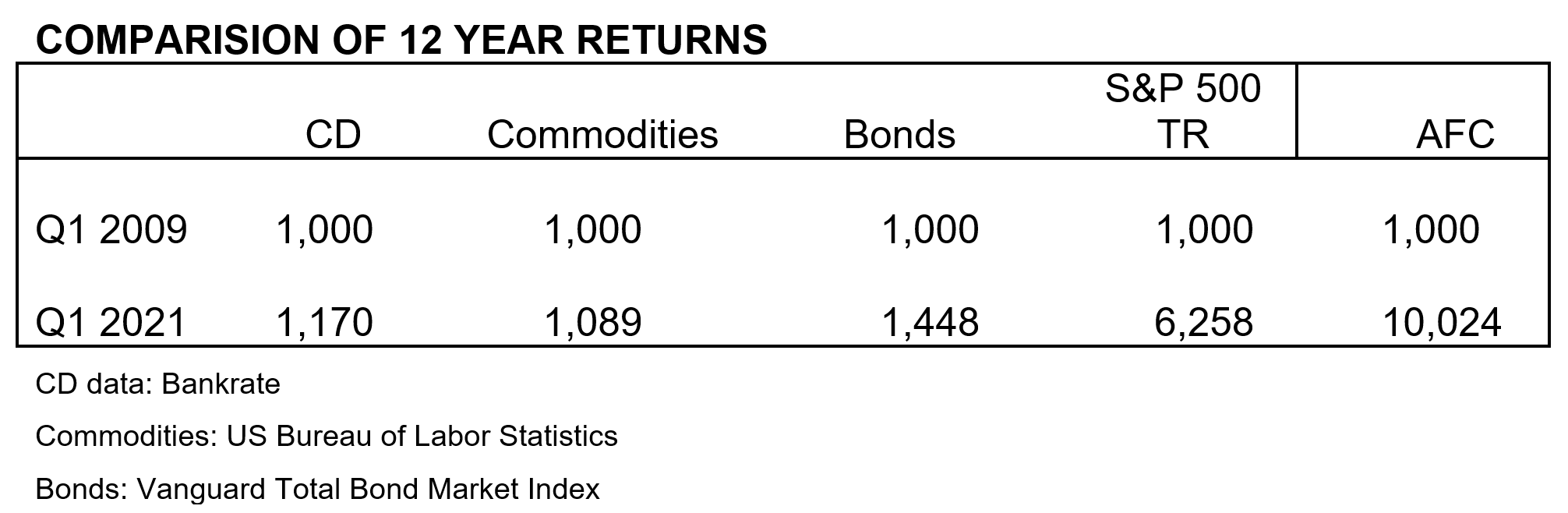

Consider the following table:

The idea of asset allocation is that when one asset class goes down, others will go up, offsetting the loss. During normal times this generally works. But in fact, during extreme black swans like the Great Recession or the COVID-19 pandemic, almost every asset class plunged.

Are we through with the unexpected black swans? My guess is there will be more to come.

But even without those unexpected black swans, asset allocation may keep clients from losing money during a market correction or even a bear market. But over the longer-term what does it do? Take another look at the table above. It does not take a genius to see that over just 12 years the cost of doing asset allocation can reduce returns by 50% or more.

Are you willing to give up half of what you might earn to avoid some down periods? Are you willing to accept some volatility, or short term loss, to potentially increase your longer-term gain?

I do realize that past performance is no guarantee of future performance. But I believe these are questions you should be asking. If your advisor is not really advising, then shouldn’t you be considering a new advisor?