She is a fun-loving, adventurous person who loves to travel the world. She embraces life enthusiastically. I’ve often heard her ask the question “why not?” She is very creative and artistic and loves to make her surroundings beautiful. She enjoys fine dining and excellent wines. She has and presently owns property out the United States so she can have a base from which to launch far-reaching adventures.

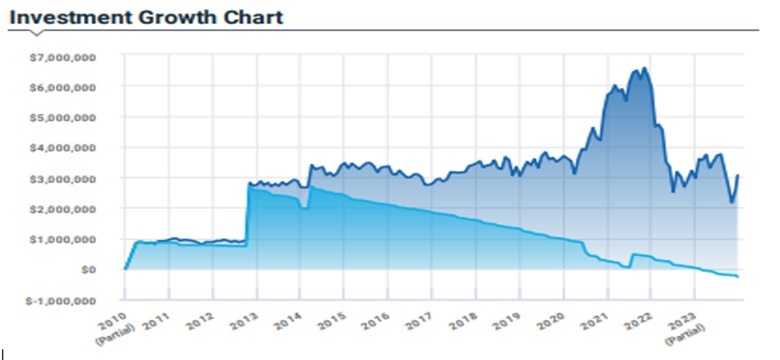

All of which sounds like being beyond the financial reach of most people. Here is the reality. She opened her accounts at Adams Financial Concepts with $ 785,580 on December 31, 2009. In 2012 she added $2,198,633 when she sold her house in Hawaii and moved to Seattle. Since that time she has been taking a monthly withdrawal of $15,000 and sometimes extra funds for travel, remodeling, or whatever. In 2023 she withdrew $ 287,446. During the time with Adams Financial Concepts, she deposited $2,984,213. She has withdrawn $ 3,046,120 and as of December 22, 2023, her accounts stood at $ 3,138,930.

Attached is the graph of how the accounts have done since they were opened. There has been significant volatility. Note that in 2020-21 the accounts soared and then fell back. We are guardedly optimistic the accounts will again hit and surpass $6,500,000 in the next several years. Note the line on the chart shows she has taken more from the account than she deposited.

Most financial advisors subscribe to Modern Portfolio Theory and Asset Allocation. In doing so they probably experience lower volatility. Studies show they also experience lower returns1. Adams Financial Concepts believes both Modern Portfolio Theory and Asset Allocation are statically faulty. Had these accounts been managed based on those incorrect approaches She would either have had to change her quality of life or run out of money.

Because Adams Financial Concepts has managed the accounts, she has maintained her “joie de vivre” traveling the world, finding new adventures.

Note 1. Goals Based Wealth Management, John Anderson and J Womack, Independent Advisor Solutions by SEI, September 2020 which states their statistics are based on the following.

Average stock investor and average bond investor performance results are based on a DALBAR study, “Quantitative Analysis of Investor Behavior (QAIB), 2018” DALBAR is an independent, Boston-based financial research firm. Using monthly fund data supplied by the Investment Company Institute, QAIB calculates investor returns as the change in assets after excluding sales, redemptions, and exchanges. This method of calculation captures realized and unrealized capital gains, dividends, interest, trading costs, sales charges, fees, expenses, and any other costs. After calculating investor returns in dollar terms, two percentages are calculated for the period examined: Total investor return rate and annualized investor return rate. Total return rate is determined by calculating the investor return dollars as a percentage of the net of the sales, redemptions, and exchanges for the period.

Further, Envestnet Management surveyed 400,000 accounts over a three-year period, 2015 to 2018. They classified the financial advisors into one of three types and found the following:

- Advisors who acted as Portfolio Managers achieved average performance of 4.61%

- Advisors who took a Unified Managed Account achieved an average performance of 3.94%

- Advisors who were fund strategists achieved an average performance of 4.10%

During that same 3 year time period the average Adams Financial Concepts account achieved 13.54% net of all fees, costs and expenses compared to less than 5% for the 400,000 accounts surveyed by Envestnet Management. Please see our website www.adamsfinancialconcepts.com for all disclosures. We have to say past performance is no guarantee of future performance.