“It ain’t over till it’s over,” said Yogi Berra, the legendary New York Yankees catcher, and it’s hard to argue with his logic. He, of course, was talking about the 1973 pennant race, but I believe it applies to the economy and the stock markets today: “It ain’t over till it’s over”.

There is good news and bad news. First the bad news:

The unemployment rate came in at 14.7% with over 20.5 million jobs lost since the pandemic hit. There are over 33 million people who have filed for unemployment. Not since the Great Depression have we seen these types of unemployment numbers. The economy is staggering under the impact of the pandemic.

While the economy and employment are addled, the stock markets are down only about 10% in general, and for my clients we are around even for the year. That is a complete disconnect from the economy. How can it be explained?

Last week, I was asked that question during the news on KING 5 TV here in Seattle. My response was and is this: the government stimulus packages. There are 133 million people who are employed but my guess is a significant number of those are employed because of the $2.7 trillion government stimulus. Businesses that were closed in the stay at home order are still in business and most of their employees are still getting paid.

Take airlines for example. The domestic airlines have reduced their flights by 90%, however the federal government has given $25 Billion to the airlines. That essentially replaces the revenues passengers would be paying for the cancelled flights. In addition, since the airlines are flying 90% fewer flights their fuel costs are down.

Airlines are but one of many examples. The unemployment supplement of $600 per week through July means some of the unemployed are getting more now than they received when they were working.

But it ain’t over till it’s over. There are ominous indications the impact of the financial stability provided by the government stimulus could be coming to an end.

I am a numbers guy. I look at the numbers to tell the story. So stay with me. This is not a political discussion. It is not a “Potemkin Village”[1] spin.

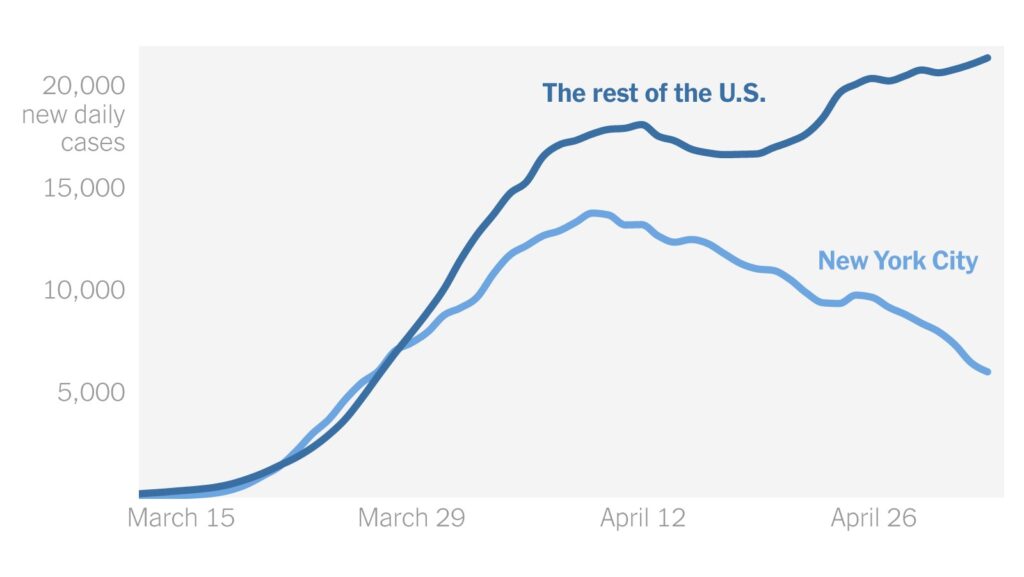

The pandemic in the United States is outsized. The United States has 4.5% of the world’s population but over 30% of the worldwide COVID-19 cases and 25% of the worldwide deaths. While there has been talk that the pandemic curve is on a downward trend, this doesn’t seem to be reality. In fact, to the contrary, when New York City’s cases are removed, the trend in the US is that new daily cases are growing, not decreasing.

In my opinion, the chances are the pandemic will be with us longer than we had hoped. There will be more cases of COVID-19 and more deaths. And that will impact the economy and the stock market.

This pandemic “ain’t over till it’s over.” I cannot imagine many people will want to go to a baseball game sitting shoulder to shoulder with strangers while the pandemic is still raging. I doubt many people will want to sit next to strangers in the movie theatre or at the ballet or the live performance theater until the virus has been tamed. I doubt many people will plan on eating at crowded restaurants knowing the stranger sitting at the next table may be contagious with the virus.

Laurie Garrett, author of The Coming Plague and Ebola, has appeared a number of times on TV and in print to say it will take 36 months to be rid of the coronavirus if everything goes perfectly. She claims if all goes well it will probably take another twelve months before a viable vaccine can be produced. If that vaccine can be administered orally, nasally, or with a patch it will cut the time needed for distribution because there would not need to be a supply chain built for syringes and vials. It would require the company that develops the vaccine does not file a patent and makes the vaccine available to any other company that wishes to produce it. Finally, it will take ten million volunteers to take the vaccine to the remotest places in the world to administer it. It would be 36 months and the likelihood of each of these steps is not guaranteed.[2]

That is the bad news. Here is the good news:

I disagree with Garrett. She is talking about eradicating the coronavirus. For the economy to return to normal we need only to have most people in the world vaccinated. Consider polio. During the first half of last century the polio virus arrived during the summer and struck without warning. It caused severe muscle pain, nerve damage, and often paralysis. In 1952 there were 57,628 cases of polio in the United States. It was feared and there were dozens of conspiracy theories about the origin and cause. In 1953 Jonas Salk developed his vaccine. Most Baby Boomers and those born after the baby boom have not experienced polio or even had it affect our lives. But polio itself continued to infect some in the world until it was eradicated in 2019.

My guess is that once a vaccine against the coronavirus is developed and given to most citizens in the United States the economy will return to normal. The fear and reaction to the coronavirus and pandemic will fade away. Until that time, the pandemic will continue to impact lifestyles and potentially the economy. But it will not be eradicated for many years.

Until that time when there is a vaccine, the economy will depend on government stimulus to replace income for the unemployed and to replace revenues for many companies whose business has been closed or reduced. Absent that government stimulus, the economy will sink, and with it the stock market. I do believe the US government will step forward, as will other governments in the world. In addition to the $2.7 trillion the US government has spent, other world governments in the world put together stimulus packages of over $8 trillion.

In my opinion, there will be companies that will do well whether we have a vaccine or continue to exist in the pandemic bubble for longer than anticipated. The index funds and ETFs made for diversification will contain some of those stocks and also stocks in companies which are negatively impacted by the pandemic. Selective stock picking will, in my opinion, achieve the best results.

Portfolios down seven to ten percent or more are still vulnerable to get hammered if there is insufficient stimulus. I believe my client portfolios are structured in such a way as to limit downside without giving away the upside.

In addition there will be a place for portfolios that are both long and short: long for the stocks that are little impacted by the pandemic and short for those stocks of companies that suffer from the pandemic.

Yogi Berra was talking about the pennant race when he stated “It ain’t over till it’s over”. I believe “the pandemic is not over till it’s over and there is a vaccine that allows us to get back to a normal economy”. Yogi was a lot more efficient in his use of words.

I write these emails as educational pieces, but also to offer my help to readers. I am proactive in trying to anticipate what is coming and to be prepared to take advantage. I do not believe a financial plan built on past averages has ever anticipated a Great Recession or a pandemic. I believe those financial plans will fail. I do not believe in an excuse like “it took everyone by surprise” or “just hang in there the market will recover”.

No, we cannot forecast the future, but we can be proactive when events like the pandemic hit and it ain’t over till it’s over. Be prepared and if you are unsure, contact me via email or a telephone call. Don’t be caught unprepared.

[1] Potemkin Village: When Catherine the Great of Russian invited dignitaries from other countries to visit Russia, she did not want them to see how the Russian people lived. She appointed General Grigory Potemkin to build a village for the purpose of showing it off to the dignitaries that the Russian people were living a much better life than they really were. The term Potemkin Village is now used to mean any construction whose sole purpose is to provide an external façade to create the illusion things are better than they really are.

[2] Holcombe, Madeline, “Life will never be the same after the pandemic passes says public health journalist”, CNN (May 8, 2020).