Touchstone Investments surveyed over 4,000 financial advisory firms and, following the conclusion of their research, recommended that advisors, in order to grow their firms, needed to eliminate their C-class clients. It is industry standard to classify clients into classes A, B, or C based on their account values or ability to add money to their accounts, but at AFC we do not categorize our clients. Each and every client is valued at AFC.

I’ve written on this before but it is so important for clients to understand their treatment by advisors. The biggest regret of Americans approaching retirement is not having enough money.1 There are only three ways to have more money: (1) inherit it; (2) save it; or (3) grow it. Most people do not have option one. Since most financial advisors do not grow accounts much more than inflation, most clients with other advisors need to save it.2 For AFC clients we want to grow savings.

In industry conferences the discussion is not about seeing that clients have enough money but rather how advisors can grow their practice and make more money for themselves. Touchstone spelled out what services an advisor should be offering to their clients based on these industry standard classifications. If you have an advisor outside of AFC, I bet you can figure out how your advisor classifies you. Are you having two face-to-face meetings every year? Are you also having two virtual meetings a year? Are you getting eight phone calls every year? If you get all of that you are an “A” client. The advisor is probably spending annually 10.4 hours on your accounts.

If you are only getting one face to face in person meeting, one virtual meeting, and four phone calls or emails each year, then your advisor most likely considers you a “B’ client. Your advisor is spending around annually 4.9 hours on your accounts.

Now, if you are not getting any in person meetings, but two virtual meetings and two phone calls a year you are a “C” client and only worth about annually 3 hours of time.

For Touchstone, that is an ideal arrangement if you must have “C” clients, but they really recommend dumping “C” clients and putting all of your focus on getting more “A” clients. There is nothing in the Touchstone approach that says anything about wanting to grow C clients into B clients into A clients. In fact, other surveys show that the average financial advisor is only growing assets at five percent (5%) a year. Even that may be a high estimate according to other surveys. If true, and with inflation running at around 5% annually, that means the average advisor is turning “A” clients into “B” clients and “B” clients into “C” clients.

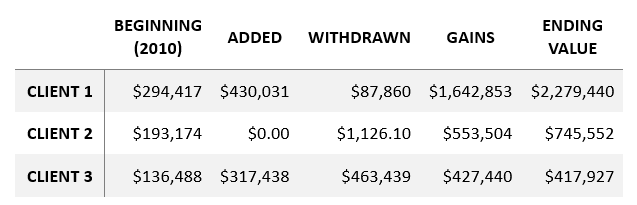

At AFC, we’ve had an unusual year, and four of our clients have passed in the last twelve months. One had only been with us a few years, but the others all started with us as, what other financial advisors would consider, “C” clients. All three clients had been commission-based until 2010 when they converted to fee-based accounts.

The point is, we want our client accounts to grow – and grow not just at 5%. Every client agreement we sign states that our goal is to see client accounts do better than the S&P 500 over the longer-term of five to ten years. Whether the account is conservative or aggressive, that is the goal. Of course, aggressive accounts tend to grow at a higher rate than conservative. But they also have greater volatility. At AFC our goal is that each client will have enough money and not experience the shortfall most other clients worry about.

We treat every client with respect, and we want to see their accounts grow. We do not abandon clients because they would be “C” clients under the Touchstone classification. We want our clients’ accounts to grow to what would be the Touchstone “A” clients. And for “A” clients that would join, we want to grow them into “AAA” clients.

Not only do we not classify our clients, the performance results we report weigh every account equally. A $100,000 account is going to have an equal weighting on the average as the $10 million account. That means we spend as much time on the smaller accounts as we do with the larger accounts.

If you are not one of our clients, how are you classified?

Mike Adams

1. Anderson, J. (n.d.). Coach through biases – yours and your clients’. SEI. Retrieved December 22, 2021, from https://seic.com/knowledge-center/coach-through-biases-yours-and-your-clients.

2. “Most Americans Have A Financial Regret But What’s Most Prevalent?” Investment News, July 24, 2023.