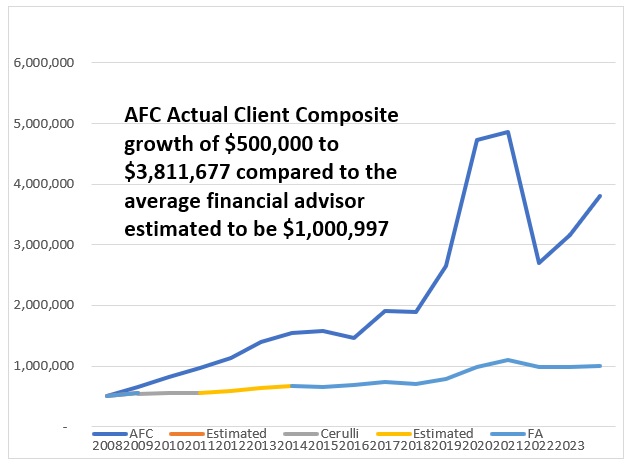

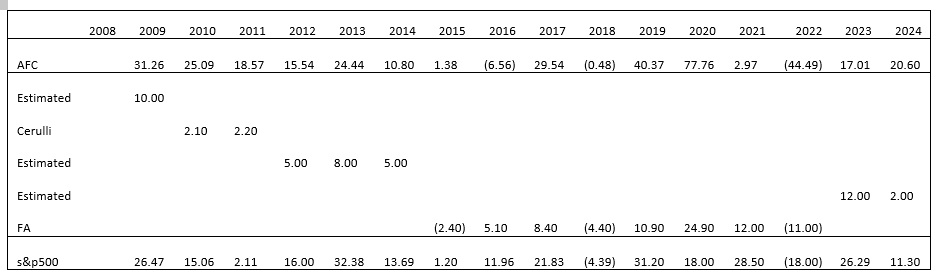

That compares to the S&P 500 with dividends reinvested at 11.3% and the average financial advisor probably a lot less. The AFC composite has trailed the S&P 500 for the past several years but that seems to have turned and our clients are again doing better than the S&P. Fewer than 3% of professional money managers can make that claim and no financial advisor that we know can make that claim. Why is it important? Over the past 25 years the economy has experienced Black Swans like the dot-com bust, the Great Recession and the pandemic. We are in the midst of that Black Elephant inflation.

In our opinion things that have never happened before happening all the time and those Black Swans and Black Elephant illustrate the damage that can be done. Those events are the past. We expect to see more in the future. Don’t you feel having more money is a better situation than facing the risk of running out of money?

Call Al Souza 206-903-1019 or email him at asouza@adamsfinancialconcepts.com

Disclaimers:

- Past performance is no guarantee of future performance.

- AFC uses the S&P 500 with dividends reinvested as the comparable index for all accounts.

- AFC Managed Accounts returns include all active accounts as well as all closed accounts with the same objective: to beat the S&P 500 over the longer-term (10 years).

- Adams Financial Concepts (AFC) Managed Accounts results are net of all fees and expenses. The results are net, net, net.

- AFC Managed Accounts do not include the results of the Incentive Profit Sharing Accounts.

- The performance presented is that of actual client accounts and includes all equity Growth Accounts with one quarter or more. These are not hypothetical, models or back tested.

Portfolios are concentrated in as few as 8 equities. Since William Sharpe received the Nobel Prize for showing there is no significant difference in volatility risk for portfolios of 8-9 stocks as compared to 300 stocks. In other